The State of Supply Chain Entrepreneurship

- ISCRO MSU

- Feb 8

- 13 min read

Updated: Feb 16

Written by Sophie Xu ( Research Lead), Veena Raigaonkar, Esha Varchasvi, & Jade Nguyen

KEY POINTS:

Venture capital is investing 15-20% of total funds in supply chain firms and technologies, highlighting growth in job creation, productivity, and innovation.

From 2020 to 2021, industries like Non-Store Retailers, Couriers & Messengers, Truck Transportation, and Waste Management saw the highest growth in new entrants (Census Bureau’s Business Dynamics Statistics).

Key drivers of entrepreneurial growth include shifts in consumer behavior, the rise of e-commerce, and increasing awareness of labor, environmental, and health concerns in supply chain operations.

The entrepreneur mindset is praised for its creativity, teamwork, flexibility, and accountability, all of which are highly sought out for in the business world. As a result, entrepreneurship shines even brighter in the face of hardships. When challenges arise, entrepreneurs take the opportunity to change the status quo and implement solutions. According to a recent report by Kearney, 15-20% of total venture capital investments are toward supply chain firms and technologies, totaling $15.4 billion this year alone, and is forecasted to increase.

At its most fundamental level, entrepreneurship is defined as individuals or groups who take financial risks to create a new business, putting themselves into high-risk, high-reward situations and opportunities. On the other hand, in the eyes of media and news, entrepreneurship often extends to start-ups, focusing on the innovation and resilience of these companies that aimed to take hold of market share and demand, and address problems possibly not yet realized. However, start-ups, can still refer to businesses that have had a few years in their journey to develop and expand its impact. For much standardized research, entrepreneurship is defined by new business formation and is especially encouraged in the United States’ dynamic and flexible economy. Its role and rate of business startups is correlated with the country’s recoveries from recessions, with business startups accounting for 20% of the United States gross job creation, and high-growth businesses accounting for 50% of gross job creation.

To identify the industries that observed the highest percentage growth in number of firms initiated within its specified year from pre-pandemic to post-pandemic, the US Census Bureau’s “Business Dynamics Statistics: Firm Age: 1978-2022" dataset records information separated by 3-digit NAICS industries was utilized for initial exploratory analysis. It is important to note that entrepreneurship is defined in these data as the creation of a new firm within the Census Bureau’s Longitudinal Business Database; this new firm could be created by a first-time entrepreneur or a serial entrepreneur. Another clarification is that this program captures dynamics as of March of the reference year relative to March of the prior year.

With the Business Dynamics Statistics data analysis of firms opened per year and comparing the percentage change of 2020 and 2021, Non-Store Retailers, Couriers & Messengers, Truck Transportation, and Waste Management, all of which have strong supply chain components, experienced high entrepreneurial growth. Most industries reported negative impacts due to the pandemic, however, consumer behavior left niche market openings and growth opportunities and allowed supply chain-oriented industries to make quick recoveries and rapid expansions. Alongside the push for driver-environmental awareness and government regulations, public and private sector initiatives, entrepreneurship from both a firm age and startup perspective were able to expand. As these industries are very broad utilizing only three NAICS digits, each industry has its own influences specific to its respective economic growth and will be broken down in the following sections.

Industry 1: Non-Store Retail [454]

Employment Growth in Non-Store Retail

The non-store retail sector saw consistent growth in employment during the pandemic. As consumer demand for online shopping surged, fulfillment centers and delivery services expanded rapidly. According to Trading Economics, employment in non-store retail increased steadily, with the number of workers rising from around 584 thousand in January 2020 to nearly 651.4 thousand by December 2021 - an impressive growth of over 11.5%. This growth highlights how essential this industry became during a time when physical stores were either closed or operating at reduced capacity.

The increase in employment also reflects the operational demands of e-commerce businesses. Because of higher demand, e-commerce businesses needed more people to run and grow the company. Other categories, such as warehousing and storage (NAICS 493), which include distribution fulfillment centers, were impacted, and required more workers to manage inventory, pack orders, and coordinate logistics. Similarly, the rise in last-mile delivery services created opportunities for drivers and couriers. This boom in employment not only supported existing companies but also created an ecosystem where new businesses could emerge and scale quickly to meet consumer demand.

Surge in E-commerce Sales and Business Opportunities

The pandemic caused a significant shift in consumer behavior, with millions of people turning to online shopping for essentials, discretionary items, and services. This behavioral shift translated into record-breaking sales for non-store retailers. According to FRED, retail sales in the sector spiked dramatically, with e-commerce experiencing a 39.4% growth rate in 2020 alone. This surge provided fertile ground for entrepreneurship, as new businesses were launched to cater to the growing demand.

Platforms like Shopify, Etsy, and Amazon played a crucial role in enabling entrepreneurs to enter the market with minimal startup costs. For example, Statista reports that e-commerce retail sales in the U.S. grew from $440.47 billion in 2020 to $516.11 billion in 2020, a 17.2% increase. This growth wasn’t limited to large retailers; small businesses and startups found success by targeting niche markets such as sustainable home goods, organic grocery delivery, and health and wellness products.

Entrepreneurial ventures flourished in specific areas where consumer needs were evolving. Grocery delivery services like Instacart and niche platforms specializing in personalized or locally sourced goods saw unprecedented demand. The flexibility of non-store retail allowed these businesses to quickly adapt to changing preferences, offering convenience, safety, and tailored experiences to their customers.

Managing Costs in a Profitable Industry

While non-store retail experienced tremendous growth, it also faced significant challenges, particularly in managing rising costs. For example, according to Forbes, shipping costs for the US-China route had gone up 13-fold from pre-COVID levels. Despite these challenges, the industry’s profitability remained robust, as increased sales volumes often outweighed higher input costs.

Entrepreneurs tackled these challenges with innovative strategies. Many turned to drop-shipping models, which allowed them to fulfill customer orders without holding large inventories. Others invested in automation and technology to streamline operations and reduce labor costs. These approaches helped businesses remain competitive and sustainable, creating a pathway for new entrants to succeed in a highly dynamic market.

Industry 2: Couriers & Messengers [492]

Impact of COVID-19 on Couriers and Messengers

For the couriers and messengers industry, COVID-19 was a transformational era that changed the workings and norms of the industry. Deliveries as a piece of the ecommerce system was a consistently growing factor, even before the pandemic. In fact, the United States’ couriers and delivery services industry had been increasing in market size by an average of 4.7% every year from 2015 to 2020. The increasingly fast-paced and highly competitive modern lifestyle has led to a parallel, increasing demand for convenient and efficient delivery services, which are spearheaded by the couriers and messengers industry.

While initially a matter of pure convenience, COVID-19 added a factor of safety to contribute to the demand of courier and messenger services. In the height of the pandemic, the popularity of grocery delivery services increased by almost 5 times, surging from 3-4% to 10-15%. To account for government regulations for the pandemic, such as quarantine rules, deliveries became an essential tool to ensure the health and safety of people while allowing them access to bare necessities and luxuries alike.

Challenges from COVID-19

While the demand for deliveries increased, the pandemic still proved to be a challenge for businesses. Being ordered to or choosing to move to the customer’s door, businesses faced the issue of declining revenues and increasing costs. Additionally, businesses were also forced to let go of employees due to changes in operations. Below is a graph that depicts the decline in the number of employees in the couriers and messengers leading up to the peak of the pandemic; however, this trend recovered quickly as the number of employees began to increase parallel to the rise in demand.

Quick Recovery from Damages

Though the pandemic has receded at this point, entrepreneurship in this industry has continued to grow. The pandemic has also continued to be an advantageous switch for existing businesses. Long-distance delivery services have become an important addition, allowing businesses to show their customers that they care about their convenience and loyalty. Furthermore, offering delivery services for products and services allows businesses to reach out to customers that are geographically difficult to reach.

The graph below shows the percentage increase in total revenue (adjusted by inflation) catapulted by the beginning of COVID-19 at the start of 2020.

Furthermore, the industry continues to grow its prices charged, as displayed by the PPI (Producer Price Index) for couriers and messengers. Comparing the two eras before and after 2020, the PPI continues increasing with a similar trend.

Development of Last-Mile Delivery Services

With the expansion of courier and messenger services resulting from the pandemic, a new industry has emerged: last mile delivery services. This service is defined as the very last step of the delivery process when a parcel or package is moved from a distribution warehouse to its destination, typically a household residence. Because of businesses moving towards the implementation of delivery services for their product or service, this system has been on a trend to expansion.

The impact of COVID-19 is particularly significant on this new industry. Limitations on physical stores drove a demand for house deliveries and businesses struggled to meet these expectations, leading to an increase in the development of last mile deliveries. According to an analysis report on last mile delivery services by Grand View Research, “companies are prioritizing enhancing their last-mile delivery capabilities to meet evolving customer expectations and preferences in the post-pandemic business landscape.”

The same report shows that as of 2022, this industry was valued at USD 132.71 billion, expected to grow at a CAGR of 8.8% leading up to 2030. The chart below displays a detailed map of the estimated growth of the last mile delivery industry in North America, divided by service type.

Overall, North America has led the market share of this industry, with more than 31% market share globally. North America experienced a large upsurge in e-commerce activities, with customers increasingly preferring online shopping over physical retail for convenience and global product variety. Additionally, the region’s up-to-date technological infrastructure has enabled the market to keep pace with demand changes, catapulting last mile delivery growth.

Though traditional last mile delivery companies such as FedEx, UPS, and USPS have dominated the industry (by up to 95% deliveries of all e-commerce orders in the US), it is a prominent field for entrepreneurship and the development of startups. Selected by speed and reliability, coverage, cost-effectiveness, and technology, below are some of the top startups in last-mile delivery of 2024 (Upper Inc):

Upper (started 2019)

Postmates (started 2011)

Instacart (started 2012)

Nuro (started 2016)

Matternet (started 2011)

Though the pandemic brought hardships for businesses, it was a significant opportunity for growth for the couriers and messengers. Leading to increased demands from customers due to safety and convenience, this industry significantly developed and created demand for last-mile delivery services.

Industry 3: Truck Transportation [484]

Trucking During COVID-19

During the COVID-19 pandemic, the trucking transportation industry faced challenges regarding health, safety, and driver shortages. “Trucking in the Era of COVID-19” from the National Library of Medicine is a study that analyzes the pandemic’s impacts on operations, public sentiments, and the health and stress levels of employees. This paper references how supply chain disruptions and changes in customer behavior impacted the industry, resulting in opportunities to transform business models. Truck transportation is powered by essential on-the-floor employees, with truck drivers often being 55 years old and over, and unfortunately, resulted in one of the highest per-capita excess mortality rates as a result of COVID-19. With poor working conditions and hours, pay cuts, unpaid leaves, and files for unemployment, the truck transportation industry experienced a sharp decline in employees working in the sector. It can be quick to conclude that as e-commerce sales grew over 30% in the first two quarters of 2020, there was an increase of demand for trucking businesses to accommodate, however, this is only a small share of trucking demand. Much of the boost in trucking employment resulted from container port activity and demand-side factors as a result of consumer spending on durable goods.

This FRED graph tells us about the number of employees in the Truck Transportation sector over the past 10 years using monthly data. The grey bar indicates the COVID-19 pandemic, in which a sharp drop from 1.52 million to 1.43 million employees is observed. However, due to the consumer demand for goods, the employee numbers steadily recover and surpass pre-pandemic counts by the end of 2022. The United States Bureau of Labor Statistics specifies that the number of employees consist of occupations including bus and truck mechanics and diesel engine specialists, first-line supervisors of transportation operators, laborers and hand movers, but mostly truck drivers.

Growth Observed After 2020

It can be hypothesized that entrepreneurship within the industry was very relevant within these two years, both related to the driver shortage, record sales, and high consumer demand. However, it can also be related to industry, which is cyclic in nature due to how inherently capital-intensive running a trucking business is, and hence it can also be hypothesized that numbers will increase and decrease whether there was a supply chain disruption or not, though not as extreme as observed as a result of the black swan event. Furthermore, the owner-operator model remains vulnerable to shifts, so there will always be some turnover because of any industry-wide disruptions.

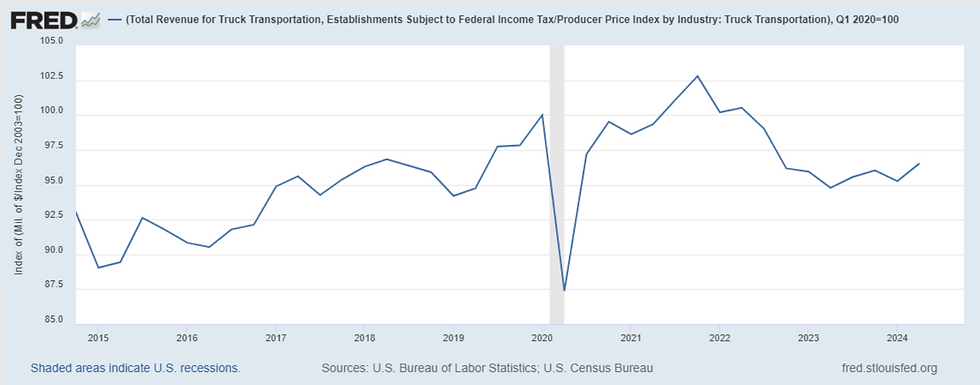

This FRED graph shows the upwards increase in Producer Price Index in the Truck Transportation industry. The significant upwards trend from 2020 to 2022 points to both the country’s inflation, but its record growth also can be taken into account in regard to the profitability of trucking businesses. The dip after 2022 relates to the decrease in the profitability of trucking businesses as a result of less consumer demand in comparison to pandemic years. It is also important to note that prior to 2020-2022, the truck transportation industry has not observed as unstable and dramatic changes in its PPI and thus has not had such extreme changes in inflation and deflation.

This FRED graph, adjusted for inflation, shows the Total Quarterly Revenue for Truck Transportation of Establishments Subject to Federal Income Tax for the past ten years. The grey bar, marking the COVID-19 pandemic, has a drastic dip, which then quickly recovers within two quarters and even surpasses pre-pandemic numbers by the end of 2021. This peak indicates how profitable the truck transportation industry was for businesses, though it decreases throughout 2022. This aftermath is a result of the industry having too many trucks with too little product demand.

The data showcases the sudden downward trend starting in mid-2022, bringing up the cyclical industry’s economic situation. However, it has traditionally taken three years to go from high to low and vice versa, and the recent high was unprecedented, causing rates to lower and giving cushioning to many trucking businesses. This, however, leaves small trucking companies (with ten or less operating vehicles) more vulnerable, which takes up more than 90% of the trucking companies in the United States. The struggles to adjust to high rates after buying high investment assets and the supply surplus for less demand have become industry-wide and continued to impact truck transportation companies of all sizes, causing companies to file for bankruptcy.

Entrepreneurial Trends and Start-Ups in Trucking

However, the cyclic industry does not stop the growth trend powered by dominating start-ups and logistic leaders with large investments into supply chain innovation. Currently, truck transportation tech start-ups place a high emphasis on data and information exchange, vehicle automation, and electric vehicles. Venture capitalists have recognized these industry trends as high-risk investments, especially as there is no established depreciation timeline or legislative approval. As a result, while many electric vehicle start-ups have continued to push development, many other logistic start-ups that stayed resilient throughout the pandemic are now struggling and shutting down.

Industry #4: Waste Management (562)

Another sector that experienced notable growth after the COVID-19 pandemic is waste management, propelled by an urgent need to address rising environmental concerns and the surge in pandemic-related waste like personal protective equipment (PPE). The industry's expansion aligns with increasing regulatory requirements, advancements in waste-to-energy technologies, and heightened awareness of sustainable practices. These factors have created fertile ground for entrepreneurial ventures and technological advancements, making waste management a critical player in the post-pandemic economic recovery.

As businesses and governments prioritize environmental, social, and governance (ESG) standards, the waste management industry has become a hub for sustainable innovation. Its growth, valued at $342.7 billion in 2023 and projected to expand by a 5.2% annual compound growth rate through 2030, showcasing the increasing demand for efficient, eco-friendly waste disposal solutions (Grand View Research; Fortune Business Insights). This growth highlights the sector’s strength and its vital role in building a greener, more sustainable future.

ESG Standards and Regulatory Forces

Furthermore, the shift toward responsible waste management is aligned with global environmental goals and environmental, social and governance (ESG) standards, further fueling the market's expansion. The U.S. waste management industry has been significantly shaped by the adoption of the Resource Conservation and Recovery Act (RCRA) and the rising implementation of Environmental, Social, and Governance (ESG) standards. These regulations encourage companies to focus on sustainable practices, driving innovation in recycling and waste disposal methods. Mergers and acquisitions in the sector reflect this shift, as larger companies such as Waste Management Inc. and Republic Services Inc. expand their market reach by acquiring smaller competitors. This trend may limit entrepreneurial opportunities in the space, as many smaller players are absorbed into these major corporations (Grand View Research).

Industrial Waste and Energy Transformation

The industrial waste sector is another key driver of growth, with sectors like electronics, automotive, and biotechnology contributing to the rising volume of waste. The application of waste-to-energy technologies, including thermochemical and biochemical methods, helps convert industrial waste into usable energy, supporting the industry's push for both environmental sustainability and economic profitability. This not only reduces waste but also helps companies reduce energy costs, making it a valuable solution (Fortune Business Insights).

Economic Impact: Waste Management’s Contribution to GDP

Additionally, publicly traded waste management firms dominate the industry, benefiting from economies of scale and government-backed initiatives to improve infrastructure. Data from the Federal Reserve Economic Data (FRED) highlights the sector’s substantial contribution to U.S. GDP, reflecting its importance in the national economy. Specifically, the GDP for Waste Management and Remediation Services in the United States grew from approximately $62.5 billion in 2019 to $73.95 billion in 2022, marking an increase of over $11.4 billion in just three years. This growth highlights the sector's expansion despite challenges such as the COVID-19 pandemic. The pandemic further exposed vulnerabilities in waste infrastructure, prompting increased investments in systems for managing personal protective equipment (PPE) and medical waste (National Library of Medicine). This growing emphasis on sustainability has accelerated government regulations and private-sector involvement, further driving market growth.

Startups Leading the Future of Waste Management

Looking ahead, innovative startups are emerging to challenge traditional players in the waste management sector. Companies such as Rubicon and TerraCycle focus on circular economy models and waste reduction technologies, offering scalable solutions for enhancing recycling efficiency and reducing environmental impact. These startups, funded by private investments and public-private partnerships, are poised to play a significant role in the future of waste management, offering new opportunities in waste reduction, resource recovery, and environmental sustainability (Grand View Research; Fortune Business Insights).

Conclusion

Through reflection of the COVID-19's impact of entrepreneurship in supply chain industries such as non-store retailers, couriers & messengers, truck transportation, and waste management, the supply chain industries that experienced the most entrepreneurial growth were heavily correlated and influenced by consumer behavior. Start-ups were able to gain more recognition and expand on their business models and operations, further fostering innovation within their respective industries and shifting the public’s and venture capitalist’s stances on their companies. As the United States continues to invest in the entrepreneurship it is so well known for, supply chain firms will stay relevant and impact the economy.

Comments