The Impact of Commodity Prices on Supply Chain Resilience and Firm Performance

- ISCRO MSU

- Nov 20, 2025

- 6 min read

Written by Vaish Akella (Research Lead), Christian Naida, Sri Harshita Boddu, Ani Bhaskar

EXECUTIVE SUMMARY:

Global supply chains are shifting from cost driven to resilience focused models, emphasizing digital innovation and risk management

Airlines such as Southwest and Delta are facing strong negative correlations with price and profitability

Aluminum prices are reflecting on industry performance, and are using hedging to stabilize costs, but cannot prevent certain disruptions

Margins show how agribusiness manage risks across various commodities

Introduction

Global supply chain strategy has evolved dramatically in response to commodity price volatility (BCG's data and analysis). Companies across food, beverage, and other commodity sectors have transitioned from cost-driven, just-in-time models to resilience-focused frameworks, integrating robust risk management, diversified sourcing, and digital innovation.

Relationship between Oil and Airline Industry

The price of oil as a commodity is very well connected with the airline industry. With jet fuel being such a large cost for major airlines, being somewhere around 25-40% of the total cost of a flight, this directly increases the COGS for each flight directly hurting their gross margin. With lower oil prices comes lower prices for jet fuel which allows airlines to buy large quantities of cheap jet fuel. Airlines do try to hedge the price of oil by buying large amounts of oil during times of cheap supply, but ultimately, there is only so much supply they can buy at any one time and with extended periods of high oil prices their gross margins will be reduced. A strong negative correlation is observed throughout the 8-year time frame between airlines including Delta, which also has a moderate strong correlation with the average price of a barrel of crude oil (-0.74).

The Southwest Airlines article highlights the strategic shift away from costly hedging toward operational flexibility in responding to volatile fuel prices. This decision gains further context when compared to industry data. For example, Delta Airlines’ stock price from 2010 to 2018 shows clear sensitivity to crude oil movements. When crude oil averaged $116.24 in April 2011, Delta’s stock fell to approximately $9.54, whereas when oil collapsed to $29.78 in January 2016, Delta’s stock rose to about $46.18. This inverse relationship demonstrates how fuel price swings directly impact airline profitability. Meanwhile, Southwest reported paying $157 million in fuel hedging premiums in 2024, a 30% increase over the previous year. Southwest historically hedged up to 47% of its expected fuel needs for 2025, but the company plans to unwind these positions opportunistically while responding operationally to fuel price changes. Together, these points illustrate that while hedging provides cost stability, it can limit upside gains when commodity prices fall. Southwest’s move toward operational adjustments, such as optimizing fleet usage and capacity, reflects a strategy that prioritizes both cost savings and flexibility while balancing resilience and firm performance in a volatile fuel market.

Metals

The price of aluminum and the performance of the various securities of the aluminum industry shows a moderately strong correlation between each security. The price of Aluminum is very important to the Aluminum industry because it determines how much the company can sell their products for and influences the price of items made from Aluminum from raw ore to finished materials. Aluminum is a far less volatile market, however, than something like oil, which makes the price far more consistent compared to other commodities like the oil market. Aluminum has many different producers and companies that focus on recycling aluminum, which creates more supply and allows for less mining in the first place. There are also no cartels which control the supply of aluminum like they do for oil with OPEC. Finally, there is also less speculation from hedge funds and traders on the aluminum commodity markets compared to the oil markets. Alcoa (AA), for example, had a moderately strong correlation of 0.53 with commodity prices of aluminum over 8 years.

Alcoa Corporation uses hedging in its strategy to manage the change in aluminum prices. The company relies on derivatives like futures and forwards to limit the impact of price changes in the commodity market. However, even with these tactics, Alcoa’s overall performance closely depends on the price of aluminum in the commodity markets. As a result, while hedging helps reduce volatility to some degree, the company’s success remains strongly linked to commodity prices overall which we also see in the data. At the end of 2024, Alcoa held around 25 million in derivative assets and $1.1 billion in derivative liabilities. They also recorded an unrealized loss from derivatives of $93 million dollars and a realized loss of $288 million dollars (Alcoa 2024 10K). This shows the size of their efforts to try and control the effects of volatility in the price of aluminum on their bottom line. Overall the link between the commodity price of aluminum and stock price of companies like Alcoa are clearly related to some degree and Alcoa takes many steps to try their best to insulate themselves from Aluminums price changes however its very clear that the price of Aluminum still has a strong effect on their stock price today.

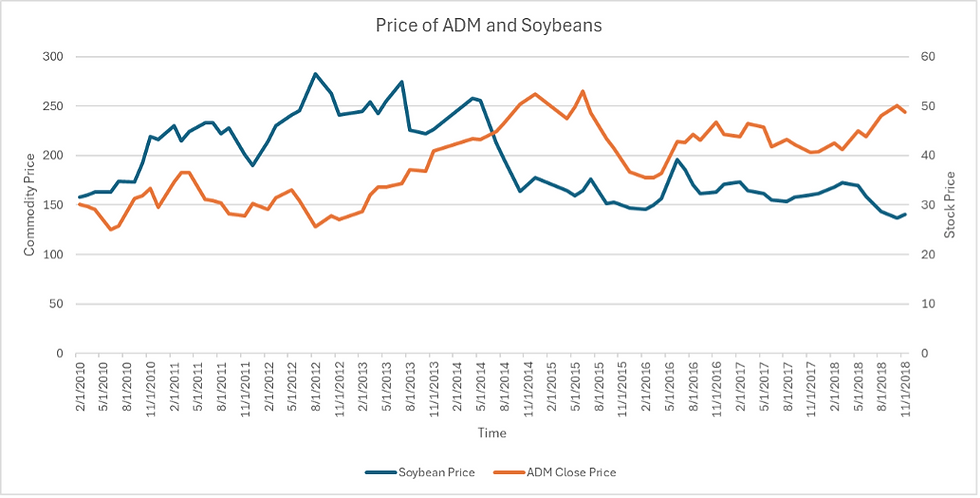

Relationship between Food Commodity Prices and Food Industry

There is an inverse, moderately strong correlation between soybean prices and Archer Daniels Midland (ADM) Company’s stock performance, a soybean processing company. This negative correlation of –0.51 may reflect the company’s position as a major agricultural processor and intermediary rather than a direct producer. Higher input costs for commodities like soybeans can compress profit margins in ADM’s processing and manufacturing operations. Conversely, when soybean prices decline, ADM may benefit from lower raw material costs, potentially improving profitability and investor confidence. This relationship highlights how fluctuations in key commodity markets can directly influence the financial performance of firms within the agribusiness sector, particularly those operating along the value chain rather than at the point of primary production. This correlation is only moderate because of the inherently diversified nature of the food industry. ADM is not only a soybean processor but also corn and grain. This same effect is highlighted with General Mills and the price of wheat.

Similarly, the price of wheat and the performance of General Mills have an inverse, moderate correlation of –0.62. Wheat prices have both increased and become more unstable, showing a 70% rise in volatility from the 2015–2020 period to 2020–2025. Much of this heightened instability can be attributed to geopolitical events that disrupted the global wheat supply and amplified market uncertainty. These dynamics have significant implications for firms reliant on wheat as a core input, such as General Mills. Wheat serves as a critical raw material in the company’s cereal products and rising input costs have placed pressure on profit margins. General Mills has acknowledged these inflationary effects but has sought to mitigate them through cost management strategies, including forward buying and supply chain deleveraging.

Beyond multinational processors like ADM, smaller regional players also face exposure to commodity price risk. Vietnam imports over six million tons of soymeal each year, mostly from Argentina, making prices sensitive to global trade and supply changes. In 2024, the Tortilla Feed Mill locked in 2,000 tons at $390 per ton, but by June the market price fell to $320, leaving the feed producer paying more than competitors who waited.

Previously, feed producers purchased soymeal at fixed prices or tied to futures without actively hedging, leaving them exposed to market swings. Combining fixed contracts with put options or using futures hedges can stabilize costs while maintaining flexibility. The Vietnam example illustrates how hedging can turn volatile commodity prices into manageable, predictable costs and support competitiveness in the food supply chain. (Case study soymeal price risk Vietnam)

In response to volatile coffee bean prices, Starbucks has adopted a strategy distinct from previous cases that doesn’t mitigate risk through forward buying. Instead, Starbucks utilizes Price-to-be-Fixed (PTBF) contracts, in which the quantity, delivery month, and premium relative to New York’s futures market are agreed upon in advance, while the final price is determined at a later date. This approach entails higher risk, as it essentially reflects Starbucks’ bet that coffee prices will remain volatile with periodic declines rather than continuing to rise. Moreover, Starbucks’ vertically integrated supply chain enhances its resilience to commodity price swings. By purchasing beans directly from growers and investing more than $150 million in farmer support programs, the company builds strong relationships with suppliers while maintaining direct visibility into global price trends.

Organizations are adopting regional and dual sourcing, investing in climate-smart agriculture, predictive AI, and resilient supplier networks to counter projections of up to 35% crop declines by 2050 and frequent market shocks. The “cost of resilience” mindset now emphasizes tracking new KPIs (such as supplier risk exposure, redundancy & diversification, supply chain visibility & transparency, lead time buffers & flexibility, response & recovery time) and scenario planning to hardwire agility and risk intelligence into core operations, ensuring firms can withstand disruptions without sacrificing long-term competitiveness and financial performance.

Conclusion

Across a variety of industries, from metals to agribusiness, there is a clear shift in how some companies may manage exposure to these volatile commodity prices. Leading companies are emphasizing flexibility through operational adjustments, sourcing, and technology. This resilience has become a huge competitive advantage in shaping the future of global supply chains.

Comments